Greenville car title loans TX operate within a regulated framework, offering swift cash secured by vehicle titles. Lenders assess vehicle value for loan amounts, with transparent terms and a 24-hour turnaround. No collateral or credit score impact, ideal for debt relief. Texas regulations protect borrowers from predatory lenders, including interest rate caps and cooling-off periods, ensuring responsible borrowing and accessible funding through Greenville car title loans TX.

“Greenville car title loans TX have gained popularity as a quick funding solution. However, understanding the legal aspects is crucial for borrowers. This article navigates the complex landscape of Greenville car title loans from a legal perspective, exploring the loan process and highlighting rights and regulations specific to Texas. By delving into these details, we aim to empower borrowers, ensuring they make informed decisions while accessing this alternative financing option.”

- Understanding Greenville Car Title Loans: A Legal Perspective

- Loan Process: From Application to Repayment

- Protecting Borrowers: Rights and Regulations in TX

Understanding Greenville Car Title Loans: A Legal Perspective

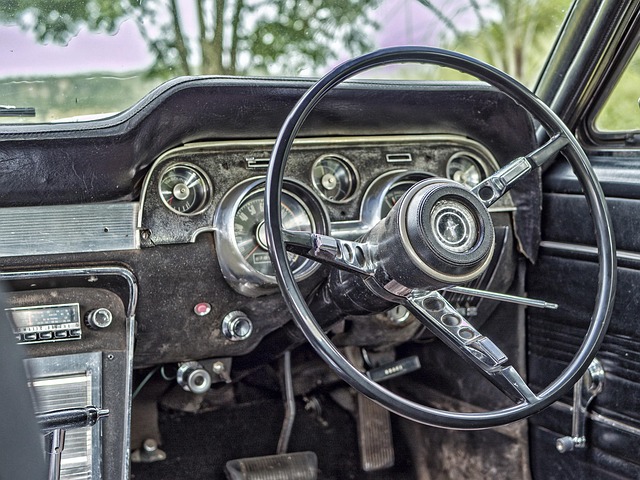

Greenville car title loans TX operate under a structured legal framework designed to protect both lenders and borrowers. These loans are secured by the borrower’s vehicle title, offering a unique advantage for those seeking quick approval and emergency funding. The process involves a comprehensive assessment of the vehicle’s value, ensuring it meets the loan-to-value ratio requirements. Lenders carefully review the vehicle’s condition, age, and overall market worth to determine an appropriate loan amount. This meticulous evaluation ensures that borrowers receive fair terms and conditions, promoting transparency throughout the entire transaction.

The legal aspects of Greenville car title loans TX prioritize swift transactions without compromising security. Borrowers can expect a streamlined process, often achieving fast cash within a short timeframe. However, it’s crucial to understand the repayment obligations and potential consequences of default. Lenders are within their rights to repossess the secured vehicle if payments lag, emphasizing the need for borrowers to adhere to agreed-upon terms. Understanding these legal implications is essential for anyone considering this form of emergency funding in Greenville, TX.

Loan Process: From Application to Repayment

The process of obtaining a Greenville car title loan TX is designed to be straightforward and efficient, catering to borrowers in need of quick funding. It begins with an online application where prospective lenders provide essential details about themselves and their vehicles. This initial step involves submitting personal information, such as name, contact details, employment status, and income proof. Additionally, applicants must furnish data related to their vehicle, including the make, model, year, and current mileage. Once submitted, these applications are swiftly evaluated by lenders who check for loan eligibility based on factors like creditworthiness and vehicle condition.

Eligible borrowers are then offered a loan amount, which they can accept or decline. Upon approval, the funds are disbursed, often within 24 hours. Repayment for these loans typically occurs over a set period, usually ranging from several months to a year. Borrowers make regular payments, which cover both the principal and interest, following a schedule agreed upon with the lender. One key advantage of Greenville car title loans TX is their flexibility in terms of repayment; unlike traditional loans, these often do not require collateral or impact credit scores. Moreover, for those seeking debt consolidation or looking to improve their credit standing, this option can provide a viable solution without the stringent requirements of a conventional loan, including a no-credit-check scenario.

Protecting Borrowers: Rights and Regulations in TX

In Texas, borrowing against your vehicle through Greenville car title loans TX is regulated to protect borrowers from predatory lending practices. The state has established clear guidelines for lenders, ensuring that consumers have access to transparent and fair terms when securing emergency funds using their vehicles as collateral. These regulations cover various aspects, including interest rate caps, loan term limitations, and requirements for clear vehicle ownership. Borrowers in Fort Worth Loans are also entitled to a cooling-off period, allowing them to change their minds within a specified time frame without incurring additional fees.

Additionally, lenders must conduct a thorough vehicle inspection to verify the condition of the collateral. This process helps maintain the integrity of the loan agreement and ensures that borrowers receive accurate appraisals of their vehicles’ value. By implementing these protections, Texas aims to promote responsible borrowing and provide an accessible solution for those seeking emergency funds, such as Fort Worth loans, without compromising their financial stability or facing excessive charges.

Greenville car title loans TX have become a popular financial solution for many residents, offering quick access to cash secured by their vehicle. However, it’s crucial to understand the legal aspects involved to protect yourself fully. This article has explored the loan process, your rights as a borrower under Texas law, and essential regulations designed to safeguard consumers in this lending sector. By understanding these key elements, you can make an informed decision about whether a car title loan is the right choice for your financial needs.